Britain’s pensions time bomb: Two in five young workers and 62% of self-employed face huge hit to living standards in retirement – because they aren’t saving enough

Britain’s pensions time bomb was laid bare today amid warnings millions of people face hardship in retirement.

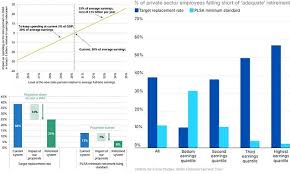

Research by the respected IFS think-tank has found 39 per cent of younger private sector workers are not saving enough to avoid big falls in living standards.

Some 13 per cent are not even on track for to reach the ‘minimum’ post-tax income – the equivalent of £13,400 for a single pensioner or £21,600 for a couple.

The problems are even bigger among self-employed, with 63 per cent not expected to meet the so-called ‘replacement rate’ for incomes and 66 per cent not even reaching the basic level.

Low-earners are particularly likely to fall short of the minimum retirement funding, with a third not saving enough.

But the transition from work to retirement is set to be particularly painful for middle and top earners.

Half of those aged between 25 and 34 who are in the higher 50 per cent to 75 per cent of incomes, and paying into defined contribution pots, are set to experience a major drop in their living standards.

The Pensions and Lifetime Savings Association (PLSA) defines a minimum standard income as a post-tax income of £13,400 per year for a single pensioner or £21,600 for a pensioner couple.

That is after housing costs and based on living outside London.

The IFS report recommended that a target should be set for the state pension to be a proportion of earnings, ‘to improve predictability’. Currently under the triple lock it rises annually by the highest out of earnings, inflation or 2.5 per cent.

It suggested minimum pension contributions by employers should be extended to ‘almost all’ employees from the first pound of their earnings.

Default pension contributions should also be increased when individuals reach the average wage, so that lower earners have their take-home pay protected.

The think-tank’s review called for a simpler system for self-employed people to build up private pensions.

And it suggested a ‘small fraction’ of the savings from increasing the state pension age should be put towards enhancing universal credit for those approaching retirement.

‘Means-tested support for pensioners should be streamlined to boost take-up, and housing benefit should be made more generous for the growing number of pensioners residing in the private rental sector,’ the report added.

The changes would reduce the proportion of 25 to 34-year-olds projected to miss their income ‘replacement rates’ by 14 percentage points.

Just 6 per cent would fall short of the PLSA minimum retirement living standard, the report estimates.

Paul Johnson, Director of IFS and co-Director of the Pensions Review, said: ‘There is much to celebrate about the current UK pensions system.

‘The current generation of retirees is, on average, doing much better than any previous generation.

‘Pensioner poverty is way down on the very high levels in the 1970s and 1980s, and is indeed below that for other demographic groups.

The IFS highlighted that maintaining the state pension at current levels relative to earnings would mean increasing the proportion of GDP spent on it

The IFS report laid out proposals it suggested would dramatically reduce numbers of workers facing hardship in retirement

‘The state pension has been simplified and is now much more generous to many women than in the past.

‘Many more employees have been brought into workplace pensions by the successful roll-out of automatic enrolment.

‘But there is a risk that policymakers have become complacent when it comes to pensions. Without decisive action, too many of today’s working-age population face lower living standards and greater financial insecurity through their retirement.’

Former Tory Cabinet minister David Gauke, who helped oversee the review, said: The government should provide a secure pension income, further increases in the state pension age should be accompanied by more support for those hardest hit, and both employees and employers should gradually contribute more to help achieve greater financial security in retirement.’